What is TST on my Bank Statement?

Introduction

TST was introduced in the 1960s as a means for banks to verify account information and to be aware of the performance of the transaction processing system.TST is known as “Test Transaction” or “Test Transfer.”

Some banks use a code to determine test transactions or transfers for different purposes. These purposes include account verification, system testing, or regulatory compliance checks. In the 2010s digital payment systems increased rapidly.

Sometimes TST may be used for ongoing charges like monthly subscriptions or memberships. By understanding the meaning of TST you can easily solve the mystery behind it and take control of your financial journey.

You May Also Read: 50 beale street san francisco charge on credit card

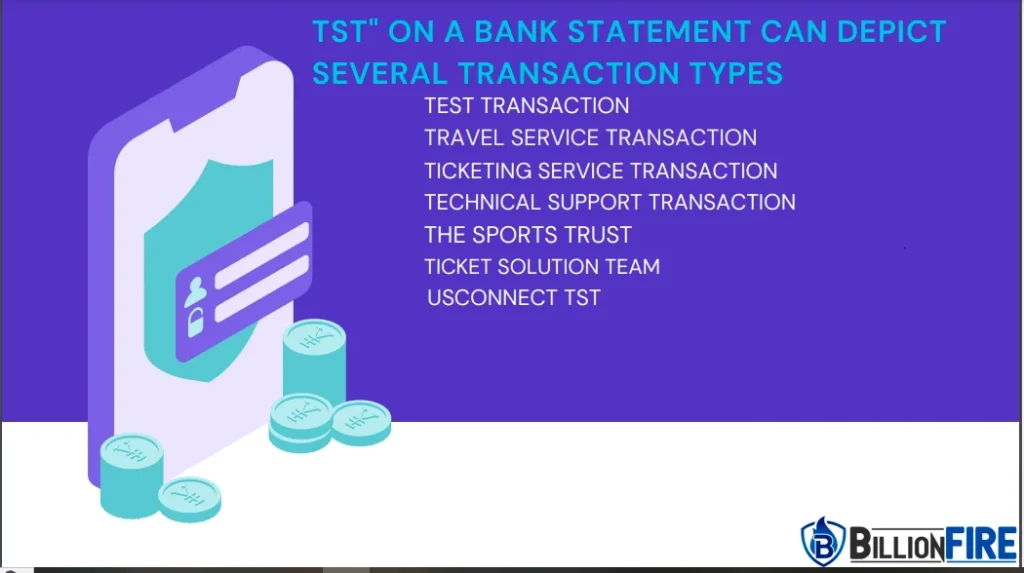

TST” on a Bank Statement can depict several transaction types

- Test Transaction(Verification of account information and working of transaction system)

- Travel Service Transaction(flight bookings, hotel reservations, or rental car services)

- Ticketing Service Transaction(ticket purchases for events, concerts, or sporting events)

- Technical Support Transaction(software-related transactions, such as IT services, Software subscriptions, Online courses, and Tech support plans)

- The Sports Trust(transactions with The Sports Trust, a non-profit organization)

- Ticket Solution Team(ticketing services provided by the Ticket Solution Team)

- USConnect TST(support transactions related to vending services)

Purpose of TST on My Bank Statement

1. Vast System testing

Financial institutes update their banking software and systems to improve security and functionality. They also introduce new features regularly.

Before offering new services to customers, banks perform broad testing to ensure that new changes work properly and do not interrupt other functions.

2. Account Validation

Sometimes, banks need to check the validity of an account. In this case, TST helps them. It allows banks to check the validity of an account without affecting the amount of the account.

3. Regulatory Standards

Financial institutes are responsible for the protection of customers’ rights and for stopping financial fraud or crimes. To ensure the safety of their system, banks have to perform “Test Transactions” or “Test Transfers.”.

4. Assurance of Quality and Training

TST is also used to train new employees to familiarize them with the banking system and procedures in a controlled setting.

Furthermore, tests are also used to check quality measures to make sure that banking procedures are being followed correctly.

Discriminating TST from Fraud

To discriminate between TST and fraud transactions you should consider below given steps:

a. Transaction of a small amount

TST involves small transactions while fraud transactions can be a big amount.

b. Cancelled Transactions

At times, TST is canceled by the bank. When this is canceled then there is no change occurring in the actual amount of the account holder.

c. Verification Process

TST transactions occur on the same day each month. It is a verification process conducted by the bank.

d. Contact your Bank

In case of any suspicious transaction immediately contact your bank. Your bank will check whether the transaction was authorized or not.

General transactions appeared as TST

1. Electronic Shopping

Firstly, this can be used to show payments for electronic shopping.

2. Transfer of funds

If you transfer money to your account or you send money to someone else’s account it also appears on your bank statement.

3. Withdraw from ATM

When you make a withdrawal from an ATM, this transaction also appears as a TST.

4. Payment service providers

Payments made to service providers are also shown by TST.

5. Electronic Payments

Payments transferred from one bank to another bank are also labeled as TST.

You May Like: What is pai iso?

Structure of TST entries

Let’s explore some TST entries:

1. Awaiting Transactions

Firstly, It can express awaiting transactions when funds are transitorily held during a purchase.

2. Internal Transfers

The bank might use TST as a universal reference for internal payments when you transfer payments between two accounts using the same bank.

3. Arbitrator Payment processors

This may represent transactions where the processor’s name might not be clear.

4. Stay Informed

By completely understanding TST you can stay informed and manage your finances better.

5. Look around for Financial Education

Attend financial literacy workshops and take advice from financial experts to better understand bank processes and management of finances.

6. Utilize Ebanking

Take a look at the features offered by the Ebanking platform. Online tools can help you track transactions and make it easy for you to understand your financial activities.

Conclusion

TST serves as a way for banks to verify account information and check the performance of the transaction processing system on your bank account. By getting more and more information about it you can easily manage your financial activities and payment transactions.TST charges consist of a small amount. However, when you are unable to understand the charges on your bank statement you should contact customer center support or physically visit your bank.

Furthermore, It is mostly used by payment processors to recognize transactions based on financial statements. This indicates different types of transactions for example online retail purchases, subscription services, utility bill payments, or ATM withdrawals.

Additionally, When you see any charges on your bank statement contact customer support to verify the charges. The customer support center will give you detailed information about the charges. Monitor your bank statements regularly this will aid you in maintaining your financial status.