The Art of Retirement Planning: Crafting a Future-Proof Strategy

Effective retirement planning is essential for securing a stable financial future. A comprehensive strategy involves assessing personal financial goals, understanding available retirement accounts, and estimating future expenses. It’s crucial to account for inflation, healthcare costs, and potential lifestyle changes. The strategy is kept in line with changing conditions by routinely evaluating and modifying it. Additionally, seeking guidance from financial advisors can provide valuable insights and help navigate complex regulations. By prioritizing a proactive approach and staying informed about investment options, individuals can build a resilient retirement strategy that adapts to their needs and fosters long-term financial security.

Understanding the Basics of Retirement Accounts

It might not be very safe to start the retirement planning process. However, demystifying the types of retirement accounts is foundational. Traditional 401(k)s, renowned for their employer-matching contributions, offer a significant advantage to employees seeking to optimize their savings. For instance, ADP’s 401(k) offerings provide a platform where such benefits can be fully harnessed, making it an attractive option for many. Alternatively, Roth IRAs, which forego immediate tax breaks in favor of tax-free withdrawals later in life, serve a different strategic purpose. Each type of account has its tax implications and withdrawal rules, underscoring the importance of choosing the right mix based on personal financial goals and tax strategies.

Balancing Current and Future Financial Needs

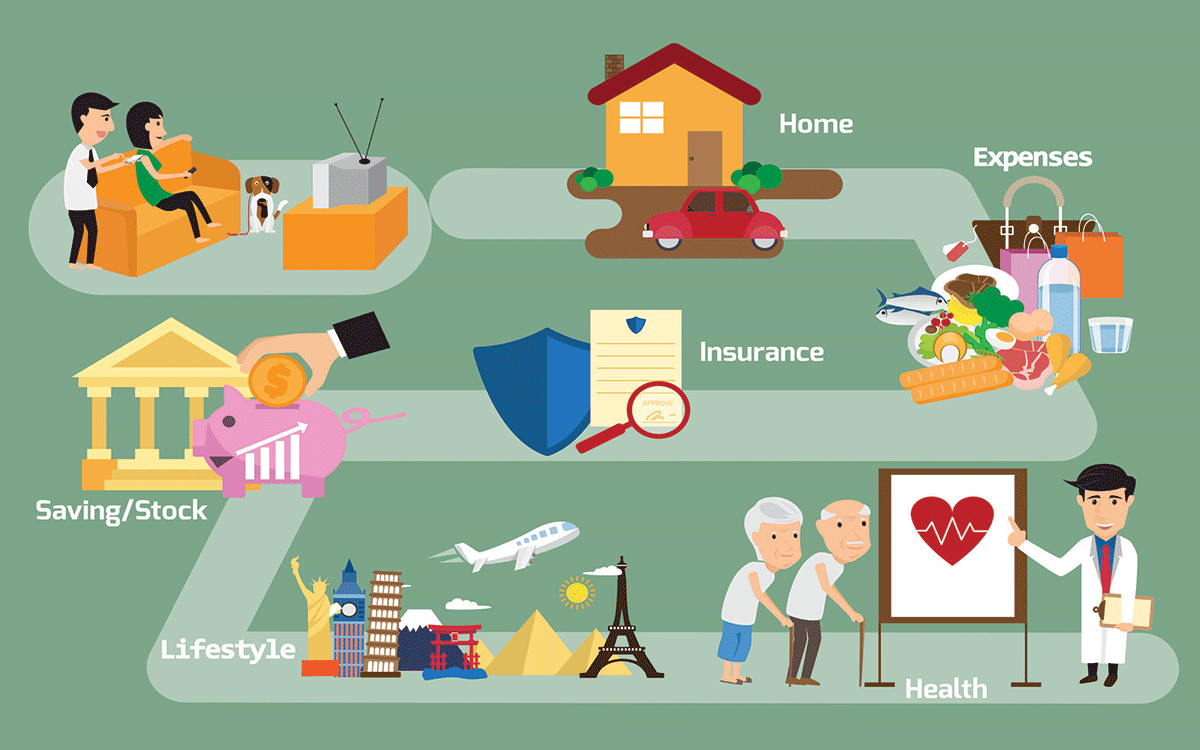

Finding harmony between enjoying life now and planning for retirement can often pose a significant challenge. Many individuals struggle to strike this balance, occasionally sacrificing current pleasures for future security or vice versa. The cornerstone of this balance is a well-crafted budget that accommodates present-day expenses and future savings goals. Setting realistic financial goals without compromising lifestyle quality ensures a fulfilling life today while confidently paving the way for tomorrow. This balance is achieved through disciplined planning, where priorities are set, expenses are monitored, and savings are diligently accumulated without curtailing life’s joys.

Investment Strategies for Long-Term Growth

A robust investment strategy for long-term growth is a pivotal element of retirement planning. Diversification across various asset classes—stocks, bonds, and mutual funds—is crucial in mitigating risk while seeking reward. You can significantly bolster your retirement savings by carefully selecting investments that match your time horizon and risk tolerance. Moreover, it’s imperative to remain proactive by periodically reviewing and adjusting these investments. Market conditions and your financial goals change; thus, a static strategy fails to capture the opportunities that come with these changes. This dynamic approach ensures that your investment plan always aligns with your evolving circumstances and the broader economic environment.

The Importance of Staying Informed

In the ever-changing landscape of retirement planning, staying informed about legislative adjustments is essential. Changes in retirement-related policies can significantly impact your planning strategy; therefore, keeping up-to-date is not merely beneficial but necessary. Leveraging reliable resources such as CNBC’s retirement section can provide timely and pertinent updates. These adaptations might involve shifts in contribution limits, tax implications, or withdrawal strategies. By staying informed, you can make nuanced adjustments to your retirement plan, ensuring optimal alignment with current regulations and potentially enhancing your savings efficacy.

Adjusting Plans for Life Changes

The unpredictable nature of life necessitates a flexible retirement planning approach. Significant life changes—career transitions, marriage, or children’s birth—can significantly impact your financial circumstances. You must remain flexible and open to revisions to align your retirement plans with your long-term objectives. By regularly revisiting and reassessing your retirement strategy, you can ensure its relevance to your current situation and effectiveness in achieving future aspirations. This proactive approach allows adjustments to accommodate fluctuating income and expenses throughout different life stages, ultimately fostering financial stability. Embracing this adaptability prepares you for unexpected challenges and ensures that your retirement planning evolves alongside your life, enhancing your prospects for a secure future.

Exploring Additional Retirement Benefits

In addition to traditional retirement accounts, exploring alternative investment vehicles can significantly enhance your retirement strategy. For example, annuities can offer a steady flow of income, serving as a safety net when regular salaries cease to be paid and assisting in paying necessary retirement expenditures. Conversely, investing in real estate offers tangible assets that tend to appreciate over time, which can generate rental income while also providing potential capital growth. However, every investment option has unique risks and benefits, so weighing them against your overall retirement objectives and risk tolerance is critical. Integrating these options into your retirement portfolio allows you to diversify your investments, adding security and stability to your financial future.

Tips for Consulting Financial Advisors

It may be challenging to navigate the complexity of retirement planning, which is why having a knowledgeable financial advisor is so important. Selecting an advisor who aligns with your financial values and comprehensively understands your personal goals is crucial for success. These professionals bring an objective viewpoint, highlighting opportunities and pitfalls you may overlook. They craft personalized strategies that consider your unique circumstances, ensuring your retirement plan is robust and tailored to your lifestyle. By collaborating with an advisor, you can develop a comprehensive roadmap that guides you toward your financial aspirations. This collaboration makes your route more transparent and allows you to make wise choices, ensuring that each action you take advances you closer to realizing your retirement goals.