How Automation Transforms Payroll Management Processes

In today’s fast-paced business environment, automation is becoming increasingly indispensable for organizations seeking to modernize their payroll processes. Through a combination of technology and innovation, companies can significantly enhance operational efficiency, minimize costly errors, and meet compliance standards with greater ease. More organizations—especially those seeking reliable payroll services Utah—are leveraging automation to enhance their payroll management and deliver a seamless employee experience.

The introduction of automated payroll solutions means less time spent on manual data entry and fewer errors, freeing HR and finance teams to dedicate their expertise to strategic business initiatives. As payroll administration grows more complex with workforce expansion and evolving regulations, automation emerges as a critical tool to keep businesses aligned, competitive, and secure.

Automated payroll platforms bring not only convenience but also confidence. Complex calculations, overtime adjustments, and variable pay structures are handled with precision, minimizing employee dissatisfaction and the associated legal risks of pay inaccuracies. As workforce dynamics change and regulatory landscapes evolve, businesses that utilize automated payroll systems gain a significant advantage.

Industry leaders utilizing payroll automation are already witnessing game-changing results—from substantial time savings to enhanced compliance and a more engaged workforce. Automation is not simply about efficiency; it’s about building a robust, versatile payroll infrastructure that is future-ready.

Enhancing Accuracy Through Automation

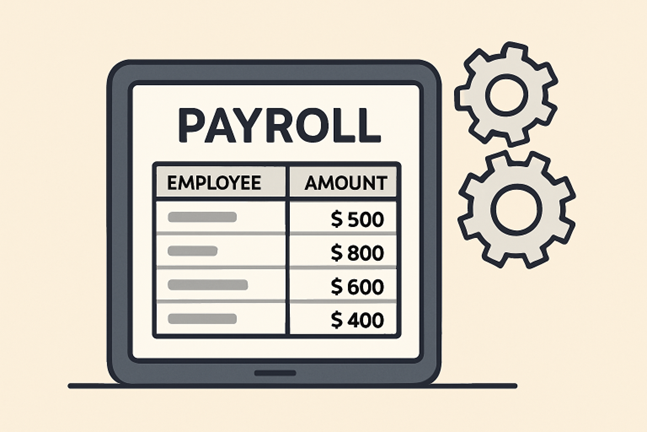

Manual payroll processes often introduce human error—even the most diligent payroll teams make occasional mistakes, whether in calculations, deductions, or data transfers. Such errors can result in underpayments, overpayments, or misfiled taxes, ultimately harming employee trust and inviting regulatory scrutiny.

Automation addresses these pain points by performing complex calculations with high precision and consistency. With AI-driven tools, payroll platforms can reconcile timesheets, validate employee classifications, and automatically process tax withholdings. These systems reduce redundancy and mitigate the risks associated with manual input, enhancing both accuracy and speed. As SHRM highlights, companies that adopt automation report a notable decrease in payroll discrepancies and improved approval workflows, contributing to a more satisfied and well-supported workforce.

Ensuring Compliance with Evolving Regulations

Adhering to continuously changing tax regulations, labor laws, and benefit requirements is a perpetual challenge for businesses of all sizes. Failing to comply, even unintentionally, may result in costly fines or damage to reputation. Automated payroll systems actively monitor legislative updates and incorporate them into their algorithms, ensuring companies remain current without the need for labor-intensive research and manual adjustments.

For example, automated systems can instantly update payroll deductions to reflect new tax brackets or benefit rules, helping organizations maintain flawless compliance. Many platforms also generate detailed audit trails and compliance reports automatically, reducing the administrative burden on HR and finance departments during audits and tax season. Automation ensures accurate wage calculations in accordance with FLSA, ACA, or local requirements, supporting businesses in their efforts to protect both employees and company interests.

read more : The Difference Between Cheap Acrylic and Quality Perspex

Freeing Up HR Resources for Strategic Initiatives

Repetitive payroll activities—such as processing timesheets, issuing payments, and answering routine employee queries—are among the most time-consuming functions in HR. Automation takes over these transactional tasks, enabling HR professionals to focus more on strategic priorities that drive organizational growth and employee success.

By shifting attention from data entry and compliance tracking to talent development, engagement strategies, and workforce planning, HR can play a greater role in shaping company culture and fostering innovation. Organizations benefit from a more agile and proactive HR team, prepared to support recruitment, retention, and upskilling objectives in an environment where people are a company’s most valuable asset.

Future Trends in Payroll Automation

The payroll industry is undergoing a rapid transformation, driven by new technologies that are delivering unprecedented improvements. The use of blockchain is expected to deliver unparalleled security, traceability, and transparency in payroll transactions, drastically reducing fraud risk and reconciliation workloads.

AI-powered voice assistants and chatbots are soon to become standard, allowing employees to get instant answers to payroll-related questions. Predictive analytics will also revolutionize workforce planning, enabling the accurate gauging of workloads and overtime forecasts to optimize resources and fine-tune compensation strategies. By embracing these trends, organizations will further streamline their payroll processes, stay resilient against regulatory shifts, and enhance overall efficiency.

Final Thoughts

Automation is more than a trend—it’s a strategic imperative for organizations aiming to enhance payroll accuracy, ensure compliance, and unlock HR’s potential for high-value initiatives. As advanced technologies evolve, businesses that invest in robust automated payroll solutions will lead in efficiency, reputation, and employee satisfaction.