Why We Overspend: Understanding Cognitive Biases in Borrowing

Have you ever found yourself overspending or taking on more debt than intended? You’re not alone. Many consumers fall prey to cognitive biases that cloud financial decision-making, especially when borrowing money. These unconscious mental shortcuts can lead you to underestimate costs, overvalue immediate gratification, and make irrational choices about credit and spending. This Hard Money Loan Experts for Los Angeles Investors guide will explore common cognitive biases in borrowing and provide practical tips to help you avoid overspending and manage debt more effectively.

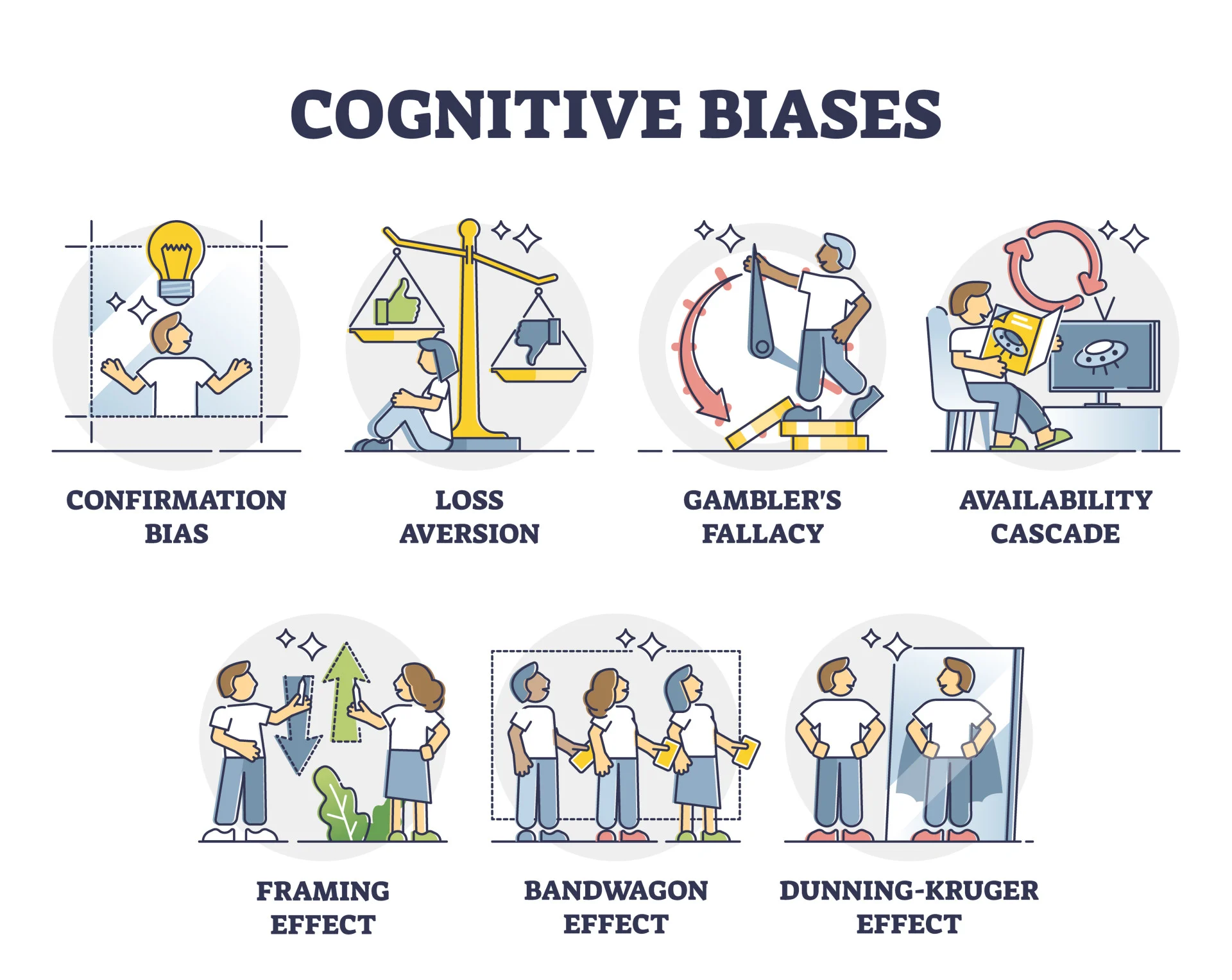

The Psychology of Overspending: Cognitive Biases Explained

Cognitive biases—mental shortcuts that can lead to irrational financial decisions—heavily influence our spending habits. Present bias causes us to prioritize immediate gratification over long-term benefits, making it easy to overspend on impulse purchases.

The anchoring effect skews our perception of value based on initial information, often leading us to overpay. Optimism bias leads us to underestimate future expenses and overestimate our ability to pay off debt. When looking for hard money loans los angeles, understanding these psychological tendencies is crucial for developing healthier financial habits and avoiding the pitfalls of overspending.

Impulse Buying and the Instant Gratification Trap

In today’s consumer culture, the allure of instant gratification often leads to impulsive spending habits. You may be caught in a cycle of immediate satisfaction, disregarding long-term financial consequences. This behavior is fueled by clever marketing tactics and the ease of online shopping, making it difficult to resist temptation. The dopamine rush associated with purchasing can create a temporary high, masking underlying emotional needs or stress.

To break free from this trap, you must cultivate awareness of your spending triggers and develop strategies to delay gratification. By implementing a “cooling-off” period before making non-essential purchases, you can make more mindful financial decisions and avoid the pitfalls of impulse buying.

Anchoring Bias: How Prices Influence Our Spending Decisions

Anchoring bias plays a significant role in shaping our spending habits. This cognitive phenomenon occurs when we rely too heavily on the first information encountered when making decisions. In financial contexts, the initial price or value we see becomes the “anchor” that influences subsequent judgments.

You may notice this bias when shopping for big-ticket items or negotiating salaries. For example, if you see a $1,000 TV first, a $800 model might seem like a bargain, even if it’s still overpriced. Similarly, in borrowing situations, the first interest rate or loan term offered can unduly influence your perception of what’s reasonable.

Understanding anchoring bias can help you make more informed financial choices and avoid overspending.

Loss Aversion and the Fear of Missing Out (FOMO)

Regarding borrowing and spending, two powerful psychological forces often come into play: loss aversion and the fear of missing out (FOMO). Loss aversion, the tendency to avoid losses over acquiring equivalent gains, can lead you to overspend on unnecessary “bargains” to avoid perceived losses.

Meanwhile, FOMO can drive you to make impulsive purchases or take on debt to keep up with peers or trends. These cognitive biases can work together, causing you to overvalue immediate gratification and underestimate long-term financial consequences. Recognizing these tendencies is crucial for making more balanced financial decisions and avoiding the pitfalls of overspending.

Tackling Cognitive Biases: Strategies to Curb Overspending

Recognize and Challenge Your Biases

To combat overspending, it’s crucial first to acknowledge the cognitive biases influencing your financial decisions. Start by keeping a spending journal to identify patterns and triggers. When making purchases, pause and ask yourself if you’re falling prey to common biases like the bandwagon effect or present bias. Challenge these thoughts by considering long-term consequences and seeking objective information.

Implement Practical Safeguards

Create a structured budget and use cash envelopes or separate accounts for different spending categories. This physical separation can help counteract mental accounting biases. Set up automatic savings transfers to capitalize on the power of defaults. Additionally, cooling-off periods for significant purchases should be utilized to avoid impulsive decisions driven by the availability of heuristics or choice overload.

Final Thoughts

As we read in this Hard Money Loan Experts for Los Angeles Investors guide and you navigate the complex world of personal finance, understanding the cognitive biases that influence your borrowing decisions is crucial. By recognizing the impact of present bias, optimism bias, and the bandwagon effect on your financial choices, you can take proactive steps to mitigate their influence. Implement strategies such as creating a detailed budget, setting long-term financial goals, and seeking objective advice from financial professionals.